Best Invoice Processing Softwares in 2025

Best Invoice Processing Softwares in 2025

Invoice processing software automates the entire process from receipt to payment, streamlining tasks and increasing efficiency.

If you’ve ever worked with an accounts payable team, you know that managing invoices is more than just paying bills. It involves capturing, coding, and matching invoices, getting approvals, and finally processing payments. And once that's done, you still need to archive everything for future audits.

It’s a time-consuming process, and when done manually, mistakes are bound to happen. These errors can cause delays, create confusion, and even cost the business. In fact, as per some studies, manually processing a single invoice can cost between 12$ to 35$.

If you're familiar with these challenges, you likely already know that the answer lies in automation. Invoice processing software streamlines the entire process, reducing errors, speeding up workflows, and saving you valuable time. Plus, it enhances compliance and reduces the risk of fraud by ensuring clear transaction trails. But with so many options out there, how do you choose the right one?

To simplify things, we’ve compiled a list of 13 of the best invoice processing software, with all the details you need to make the right choice for your business.

What is Invoice Processing Software?

Invoice processing software helps businesses manage the flow of invoices from vendors, streamlining the entire process from receipt to payment. It automatically captures invoice data, matches it with purchase orders, and checks the accuracy of items before approval for payment. This automation speeds up accounts payable (AP) processing, reduces costs, strengthens vendor relationships, and leads to informed decision-making.

13 Best Invoice Processing Software

Here's a detailed list of the best invoice processing software, along with key features, pros and cons, pricing, and who it's best suited for.

1. Stampli

Stampli is a cloud-based accounts payable platform that simplifies and automates invoice management. It helps businesses process invoices faster, reduce manual tasks, and improve cash flow.

Key Features

• Uses Artificial Intelligence for invoice capture, GL coding, approval routing, and fraud detection.

• Integrates with Stampli Direct Pay for ACH payments, both domestic and international.

• Offers a vendor portal for onboarding, information collection, and tracking invoice statuses.

• Accelerates payments through electronic funds transfers.

• Supports native functionality for over 70 ERP systems like Sage, Microsoft, SAP, and Oracle

Pros

Cons

Pricing: Stampli uses a usage-based pricing model with monthly or annual contracts. Pricing is available upon request.

Best For: Medium to large organizations.

2. Xero

Another cloud-based accounting software designed for small enterprises is Xero. It simplifies invoicing, automates approval processes, and integrates easily with various accounting tools, saving time for finance teams.

Key Features

Pros

Cons

Pricing: Starts at $29 per month.

Best For: Small businesses.

3. Expensify

Expensify is an all-in-one financial management tool that helps businesses track expenses, manage invoices, plan travel, and handle bill payments easily.

Key Features

Pros

Cons

Pricing: Plans for companies start at $5 per member.

Best For: Freelancers and small business owners.

4. Spendflo

Spendflo provides businesses with a comprehensive solution to manage and optimize their SaaS spending. It automatically captures invoices from various SaaS vendors, categorizes them, and tracks renewal dates. Additionally, it helps identify unused licenses or duplicate subscriptions, driving cost savings.

Key Features

Pros

Cons

- Focuses solely on SaaS-related expenses.

Pricing: Offers subscription-based plans or custom pricing based on business needs and budget.

Best For: Businesses looking for an effective and efficient solution to manage and optimize SaaS spending.

Joshua Pozmantir, Ripcord's VP of Finance says- Ripcord's software spend was out of control, especially with AWS. Spendflo provided the visibility we needed to optimize licenses and cut down on unnecessary costs.

5. Tipalti

Tipalti is an accounts payable platform designed to simplify global payment processes for companies. It automates the entire supplier payment workflow, including onboarding, invoicing, approvals, tax compliance, payments, and reconciliation. This makes it easier for businesses to manage vendor payments efficiently and remain compliant with tax regulations.

Key Features

- Global payment management (supports 190+ countries).

- Vendor management and self-service portal.

- Payment processing through ACH, wire transfer, and PayPal.

- Automated tax compliance.

- Invoice capture and approval workflows.

Pros

Cons

Pricing: The starter plan starts at $99 per month. Based on company needs, custom pricing is available for other plans.

Best For: Medium to large businesses.

6. Airbase

Airbase is a spend management platform that combines invoice payments, corporate card spending, and expense management. It allows finance teams to maintain control over company expenditures while offering visibility and insights into company spending patterns.

Key Features

Pros

Cons

Pricing: They offer enterprise, standard, and premium packages. To get the exact quote, contact their sales team.

Best For: Growing businesses or mid-sized companies.

7. SAP Concur

Trusted by Fortune 500 companies for years, this cloud-based solution simplifies managing expenses, corporate travel, and reimbursements. It automates expense reporting, streamlines travel bookings, and integrates with corporate cards and business intelligence tools.

Key Features

- Mobile app for automatic invoice routing and approval.

- Complete spend management with ERP integration.

Pros

Cons

- Integration can be complex and difficult to customize.

- Interface is not very intuitive.

- Slow to roll out new features.

- Limited accounts payable functionality compared to other platforms.

Pricing: Custom pricing is based on features and includes variable licensing costs.

Best For: Large enterprises that need seamless SAP integration.

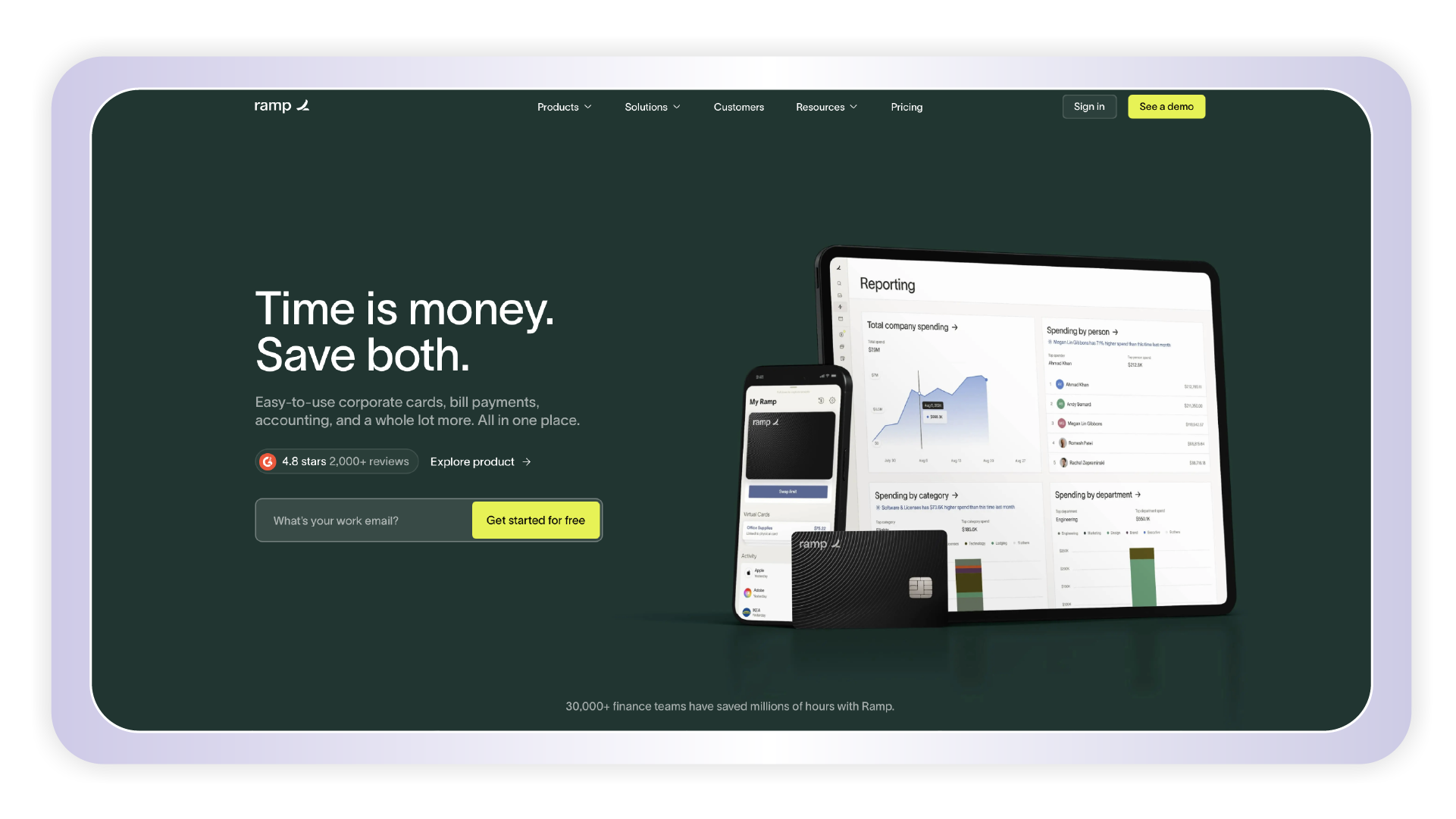

8. Ramp

Ramp is an all-in-one expense management platform that combines corporate cards and expense tracking to help businesses save money and streamline processes. It supports accounts payable, procurement, and travel management on a single platform, making it easier for businesses to manage spending and grow efficiently.

Key Features

- Detects duplicate invoices, automates approval workflows, and matches purchase orders.

- Pay bills via checks, cards, ACH, or international wires in one platform.

- Global payments in USD and over 40 currencies across 195 countries.

- Spend analysis with detailed vendor tracking.

- Extends payment terms and automates recurring payments.

Pros

Cons

- Basic accounts payable workflows.

- Does not process a batch of invoices.

- Cannot tag expense reports.

- Some users have reported poor customer service.

Pricing: Includes a free tier and offers Ramp Plus with a 30-day free trial.

Best For: Growing businesses seeking a unified platform for managing corporate cards, invoicing, and expenses.

9. Invoice2go

Invoice2go is user-friendly invoicing software designed to help businesses create and manage invoices easily. It simplifies the billing process with customizable templates, instant invoicing, and payment tracking.

Key Features

- Personalize invoices with your logo, brand colors, and layout for a professional look.

- Track invoice status and set automated reminders.

Pros

- Easy to use.

- Mobile app is intuitive and convenient.

- Offers various customization options.

Cons

- Not ideal for more complex small businesses.

- Limited integrations in the Starter plan.

Pricing: Its lowest Starter plan starts at 59.99$ for a year.

Best For: Freelancers, enterprises, and small businesses.

10. BILL

Previously known as BILL.com, it’s an easy-to-use cloud-based platform designed to handle your business's cash flow. It simplifies bill payments, invoicing, accounts payable, and receivables, giving you a single place to manage financial processes.

Key Features

- Cloud-based system for easier accounts payable management.

- Automatically syncs with popular accounting software.

- AI-powered tools for invoice capture and duplicate detection.

- Flexible payment options, including ACH, international transfers, and credit cards.

Pros

- Simple and user-friendly interface.

- Integrates with accounting tools like QuickBooks, NetSuite, and Xero.

- Improves AP and AR workflows.

Cons

- Pricing may be high for small businesses.

- Integration can be challenging for some users.

- Advanced features may feel overwhelming for beginners.

- Limited insights in certain areas.

Pricing: Plans start at $45 per user/month.

Best For: Small to medium-sized businesses.

11. QuickBooks

QuickBooks is one of the most widely used financial software tools, offering a range of features to manage receipts, maximize tax deductions, and handle invoicing and payments.

Key Features

- Record-keeping and detailed reporting, with over 50 reports in the entry-level plan.

- Integrates with 750+ apps.

- Customizable invoice templates.

- Payment dispute protection for card payments.

Pros

- Very user-friendly interface.

- Seamless integration with over 750 apps.

- Provides phone support and live expert assistance for all plans.

Cons

- More expensive than some alternatives.

- Limited number of users per plan.

Pricing: Starts at $10.50 per month.

Best For: Small and medium-sized businesses and non-profits.

12. FreshBooks

FreshBooks is a user-friendly invoicing and accounting software designed for small businesses and freelancers. It helps manage invoices, track time, and handle expenses with simple, intuitive tools.

Key Features

- Customizable invoices.

- Recurring billing with automatic reminders.

- Time tracking and expense management.

- Integration with PayPal, Stripe, and more.

Pros

- Easy integration with other apps.

- Intuitive and simple to use.

- Generates detailed and robust reports.

Cons

- Limited number of users and clients.

Pricing: Its Lite plan starts at $3.8 per month.

Best For: Small businesses and freelancers.

13. NetSuite

This cloud-based platform combines ERP, financial management, CRM, and eCommerce, providing businesses with a unified solution. It streamlines operations, automates processes, and offers real-time insights into financial and operational performance.

Key Features

- Automated invoice scanning and data capture.

- 3-way matching automation.

- Customizable approval workflows.

- Real-time cash flow visibility.

- Vendor portal for self-service.

- Advanced reporting and dashboards.

Pros

- Part of a comprehensive ERP solution.

- Strong real-time reporting capabilities.

- Scalable for growing businesses.

Cons

- Expensive for smaller businesses.

- Setup and customization can be time-consuming.

Pricing: You will have to contact them for a custom quote.

Best For: Medium to large enterprises.

Features of the Invoice Automation Software

Below are some of the key features of an invoice processing solution-

1. OCR Technology

A standout feature of invoice automation software is the use of OCR technology, which many systems lack. This technology automatically extracts key details such as vendor name, invoice number, amount, and due date from invoices in various formats, including paper, PDFs, or emails.

2. Customized Approval Workflows

You can set up automated approval processes based on factors such as invoice amount or department. For instance, high-value invoices may need more scrutiny and approval from senior management personnel. The system also tracks the approval status, showing who approved the invoice and who has yet to sign it.

3. Vendor Management

All supplier information, including contact details and payment terms, is stored in one place. Vendors can update their information, track payments, and check contract statuses through a dedicated portal.

4. Real-Time Insights

Real-time reports provide insights into spending, processing times, and payment trends. Dashboards are customizable, giving you easy access to key data points. Advanced systems can also flag unused licenses, fake invoices, or duplicate subscriptions in your SaaS stack, helping you reduce costs.

5. Automatic Invoice Matching

No need to manually match assigned invoices anymore. The software automatically compares invoices against purchase orders and delivery records. In case of any mismatch, discrepancies are immediately flagged for review, helping prevent overpayments or errors.

6. Efficient Payment Processing

Once invoices are approved, the software manages payments via ACH, checks, or wire transfers. It also supports international payments, schedules transactions, and sends automated payment notifications to vendors.

How to Choose the Best Invoice Processing Software?

We get it - after exploring so many invoice automation software solutions, it might start to feel like they’re all the same. But that couldn’t be further from the truth! Each has its strengths, and what works for one business might not work for another. To help you find the perfect match, here are five simple steps to guide you toward the best choice for your needs.

1. Automation Capabilities

Opt for software that automates repetitive tasks like invoice matching, approval workflows, and data extraction. It should also allow for digital signing of documents directly on the platform. This reduces errors, saves time, and speeds up processing.

2. Integration Capabilities

Make sure it integrates seamlessly with your current tools like ERP or accounting systems. Also, look for features like smooth data transfer, compatibility, and bi-directional syncing to maintain consistent records across platforms.

3. User-Friendly Interface

A simple, intuitive interface helps your team adapt quickly without extensive training. User-friendly design improves efficiency and reduces errors.

4. Real-Time Tracking and Insights

Next, see if the software provides real-time updates on vendor invoice statuses, payment schedules, and comprehensive reports. Such insights help you identify unnecessary SaaS spending and reduce costs.

5. Compliance and Security

Your data security is non-negotiable. Choose software that is certified with standards like SOC 2 Type 2 and ISO 27001 and complies with GDPR and CCPA requirements.

Track SaaS Invoices and Expenses With Spendflo

At Spendflo, our spend management platform simplifies how businesses manage their spending, especially when it comes to SaaS expenses. The platform tracks your expenses in real-time and automates the entire SaaS procurement process, from request and approval to provisioning. This reduces manual data entry, cutting down on errors and saving valuable time.

Spendflo also integrates seamlessly with your existing accounts payable and procurement systems, ensuring that every SaaS invoice is properly captured and managed. By doing so, it gives your team the flexibility to focus on more important tasks while keeping better control over budgets.

Ready to make invoice processing easier and more efficient? Book a demo with us today!

FAQs

Can I invoice in a different currency?

Automated invoice processing systems can handle invoices in various languages and currencies. They use smart technology to extract and validate data accurately, making it easier to process invoices from different countries and regions.

What is AI invoice processing?

AI invoice processing uses technologies like machine learning, optical character recognition (OCR), and natural language processing to automate tasks. It reads and processes invoice data from different formats, fills in details, and verifies entries, reducing the need for manual work.

Which software is best for invoice management?

There are many efficient software options to streamline invoicing, such as Airbase, NetSuite, FreshBooks, and Ramp. If you’re looking for a solution for managing SaaS expenses, Spendflo is a great option. It automates the entire SaaS procurement process—from requests and approvals to provisioning. It integrates smoothly with your existing AP and procurement systems to ensure accurate invoicing and timely approvals.

How long does it take to implement invoice automation software?

The time it takes to implement invoice automation software depends on the complexity of your accounts payable processes and the software you select. Typically, businesses can expect the process to take anywhere from a few weeks to a few months.

.png)

.avif)